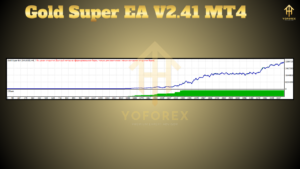

Gold Super EA V2.41 MT4: Optimized for Precious Metal Trading

Gold Super EA V2.41 is an expert advisor designed specifically for trading gold (XAUUSD) on the MetaTrader 4 (MT4) platform. Built with advanced algorithms tailored to the unique characteristics of the gold market, this EA enables traders to capture profitable moves with precision and minimal manual effort. Let’s explore what makes Gold Super EA V2.41 an ideal tool for trading this highly sought-after asset.

Key Features and Settings Of Gold Super EA V2.41

- Platform: MT4

- Currency Pair: XAUUSD (Gold)

- Minimum Deposit: $500 for optimal performance

- Timeframe: M1, M5 for short-term trades; H1 for trend trades

- Lot Size Management: Adjustable for dynamic or fixed lot sizes

- Risk Management: Includes built-in Stop Loss (SL) and Take Profit (TP) settings

This EA is specifically optimized for gold’s price volatility and liquidity, allowing it to capitalize on short-term price shifts and trend reversals. It also comes with a robust risk management system to mitigate potential losses.

How Gold Super EA V2.41 Works

The EA combines trend-following with scalping strategies to suit different market conditions. During stable trends, it takes long positions, securing profits as the price rises. For high-volatility periods, the EA employs a scalping strategy, capturing small, frequent profits. This dual approach allows traders to maximize returns while minimizing drawdowns.

Why Choose Gold Super EA V2.41?

Gold Super EA V2.41 is ideal for traders who want to benefit from the gold market’s dynamic movements without constant monitoring. With automated strategies and a focus on risk management, this EA is a reliable option for consistent gold trading.

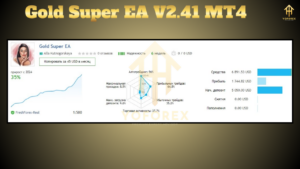

To compare Yo Scalper-X Deluxe Edition V1.0 MT4 and Gold Super EA V2.41 in a structured and detailed manner, I will create a chart with different sections such as Features, Strategies, Minimum Deposit, Time Frame, Platform, and more. Here’s a comparative analysis in chart format, followed by an expanded explanation for each aspect.

Comparing Gold Super EA V2.41 MT4 with Yo Scalper-X Deluxe Edition

In this section, we’ll compare the Gold Super EA V2.41 MT4 with Yo Scalper-X Deluxe Edition V1.0 MT4. The table below highlights the key differences between both systems.

| Criteria | Yo Scalper-X Deluxe Edition V1.0 MT4 | Gold Super EA V2.41 MT4 | ||

|---|---|---|---|---|

| Platform | MT4 | ✅ | MT4 | ✅ |

| Currency Pairs | XAUUSD | ✅ | XAUUSD | ✅ |

| Minimum Deposit | $100 | ✅ | $500 | ❌ |

| Recommended Deposit | $300 | ✅ | $500 | ❌ |

| Lot Sizes | 0.01 – 0.5 lots | ✅ | 0.01 – 1.0 lots | ❌ |

| Time Frame | M1, M5 | ✅ | M1 | ✅ |

| Trading Frequency | High | ✅ | Low to moderate | ❌ |

| Stop-Loss and Take-Profit Settings | Fixed SL/TP | ✅ | Customizable SL/TP | ❌ |

| Trading Strategy | Scalper based on SMC & Order block | ✅ | Martingale & Hedging | ❌ |

| News Time Trade | NO | ✅ | YES | ✅ |

| Drawdown | 10-15% | ✅ | 15-20% | ❌ |

| Suitable Account | Only real account | ❌ | PROP FIRMS & real account | ✅ |

Stay Updated:

Instant Download:

Gold Super EA V2.41 MT4

(https://yoforexea.com/product/gold-super-ea-v2-41/)

OR

Yo Scalper-X Deluxe Edition

Yo Scalper-X Deluxe Edition vs. Gold Super EA V2.41 MT4

Comparison

- Market Focus:

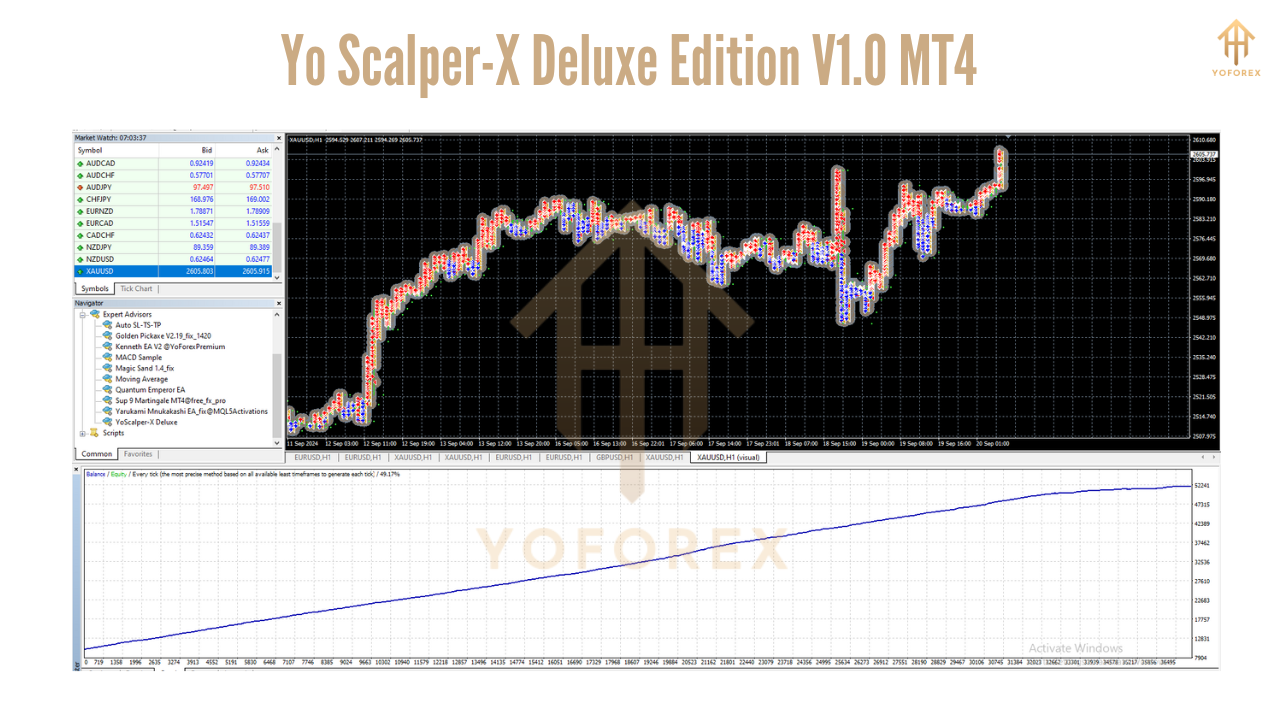

- Yo Scalper-X Deluxe Edition: Versatile, applicable to multiple currency pairs.

- Gold Super EA V2.41: Specialized for gold trading.

- Trading Approach:

- Yo Scalper-X Deluxe Edition: High-frequency scalping for quick, small gains.

- Gold Super EA V2.41: Breakout strategy targeting larger movements in gold prices.

- Customization:

- Yo Scalper-X Deluxe Edition: Offers various risk profiles to suit different trader preferences.

- Gold Super EA V2.41: Pre-configured settings for ease of use, minimizing the need for user adjustments.

Both EAs offer unique advantages tailored to specific trading styles. Yo Scalper-X Deluxe Edition is ideal for traders seeking high-frequency scalping across various currency pairs, providing flexibility in risk management. In contrast, Gold Super EA V2.41 is suited for those focusing on gold trading, offering a specialized approach with minimal configuration requirements.

Selecting between the two depends on your trading objectives, preferred markets, and risk tolerance. It’s advisable to test each EA on a demo account to assess compatibility with your trading strategy before deploying them in live trading environments.