Swing Trade Hedge for Prop Firms EA V1.0 MT4: Revolutionizing Prop Trading Strategies

Swing Trade Hedge for Prop Firms EA V1.0 MT4 is a cutting-edge automated trading tool tailored specifically for traders aiming to excel in prop firm challenges and maintain funded accounts. Designed with precision and efficiency, this expert advisor leverages swing trading strategies combined with hedging mechanisms to ensure steady growth and controlled risk.

- Platform: MetaTrader 4 (MT4)

- Primary Trading Style: Swing trading with hedging to mitigate market reversals.

- Risk Management: Focused on low drawdown, adhering to strict prop firm guidelines.

- Supported Instruments: Works seamlessly with major currency pairs and indices.

- Trading Frequency: Optimized for medium-term trades, avoiding over-trading.

Why Choose Swing Trade Hedge for Prop Firms EA?

- Prop Firm Compliance: This EA is tailored to meet the specific requirements of prop firms, such as daily loss limits, overall drawdown, and consistent profitability.

- Advanced Hedging: It employs dynamic hedging strategies to protect against market volatility, making it an ideal choice for high-stakes trading environments.

- Customizable Settings: Adjust lot sizes, risk levels, and trade frequency to align with your trading goals and the rules of your prop firm.

- Steady Growth: Swing trading ensures trades align with market trends, reducing the chances of frequent losses and maintaining a consistent profit curve.

Perfect for Prop Firm Traders

Whether you’re attempting to pass a challenge or maintaining a funded account, Swing Trade Hedge for Prop Firms EA V1.0 MT4 is your ultimate ally. Its sophisticated algorithms and compliance-friendly strategies make it a standout tool for achieving long-term success in the prop trading space.

Start your journey toward consistent profits with Swing Trade Hedge for Prop Firms EA V1.0 MT4 and experience the difference in automated trading for prop firms.

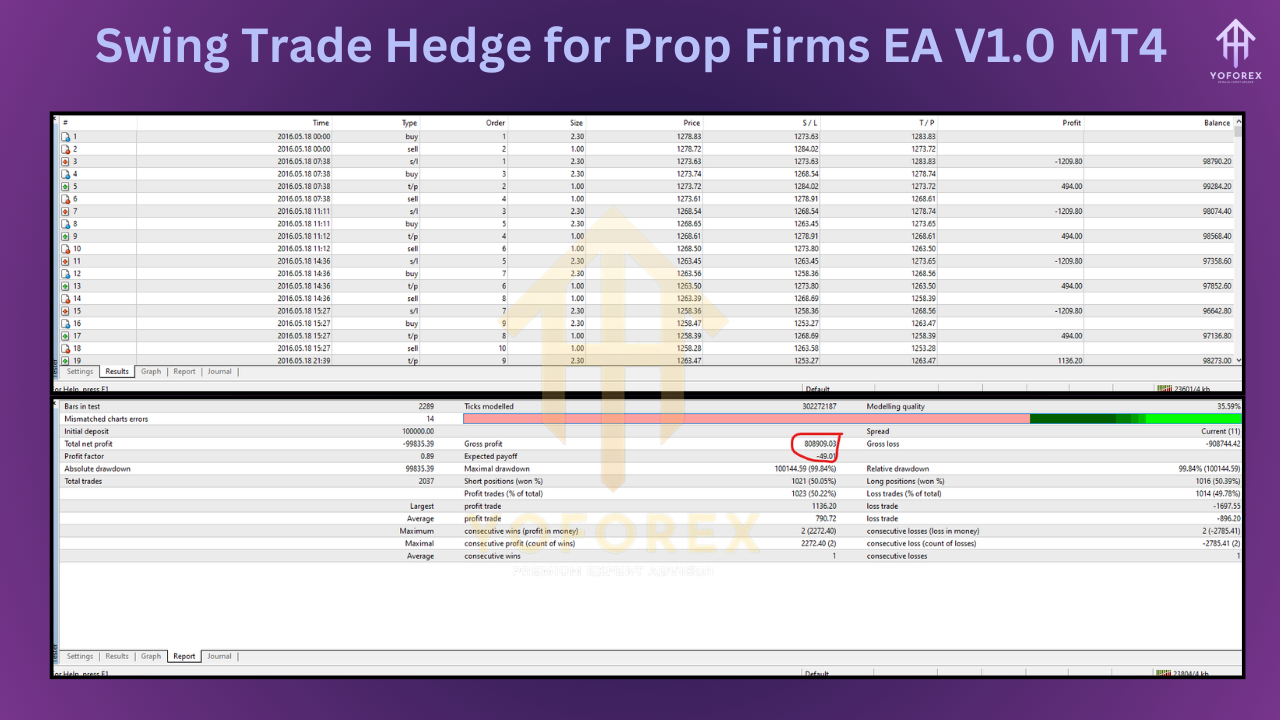

To compare Yo Scalper-X Deluxe Edition V1.0 MT4 and Swing Trade Hedge for Prop Firms EA V1.0 MT4 in a structured and detailed manner, I will create a chart with different sections such as Features, Strategies, Minimum Deposit, Time Frame, Platform, and more. Here’s a comparative analysis in chart format, followed by an expanded explanation for each aspect.

Comparing Gold Cloud EA V1.1 MT4 with Yo Scalper-X Deluxe Edition

In this section, we’ll compare the Swing Trade Hedge for Prop Firms EA V1.0 MT4 with the Yo Scalper-X Deluxe Edition V1.0 MT4. The table below highlights the key differences between both systems.

| Criteria | Yo Scalper-X Deluxe Edition V1.0 MT4 | Swing Trade Hedge for Prop Firms EA V1.0 MT4 | ||

|---|---|---|---|---|

| Platform | MT4 | ✅ | MT4 | ✅ |

| Currency Pairs | XAUUSD | ✅ | XAUUSD | ❌ |

| Minimum Deposit | $100 | ✅ | $100 | ✅ |

| Recommended Deposit | $300 | ✅ | $500 | ❌ |

| Lot Sizes | 0.01 – 0.5 lots | ✅ | 0.01 – 1.0 lots | ❌ |

| Time Frame | M1, M5 | ✅ | D1 | ❌ |

| Trading Frequency | High | ✅ | Low to moderate | ❌ |

| Stop-Loss and Take-Profit Settings | Fixed SL/TP | ✅ | Customizable SL/TP | ❌ |

| Trading Strategy | Scalper based on SMC & Order block | ✅ | Martingale & Hedging | ❌ |

| News Time Trade | NO | ✅ | YES | ✅ |

| Drawdown | 10-15% | ✅ | 15-20% | ❌ |

| Suitable Account | Only real account | ❌ | PROP FIRMS & real account | ✅ |

Stay Updated:

Instant Download:

Swing Trade Hedge for Prop Firms EA V1.0 MT4

(https://www.forexfactory.cc/product/swing-trade-hedge-for-prop-firms-ea-v1-0/)

OR

Yo Scalper-X Deluxe Edition

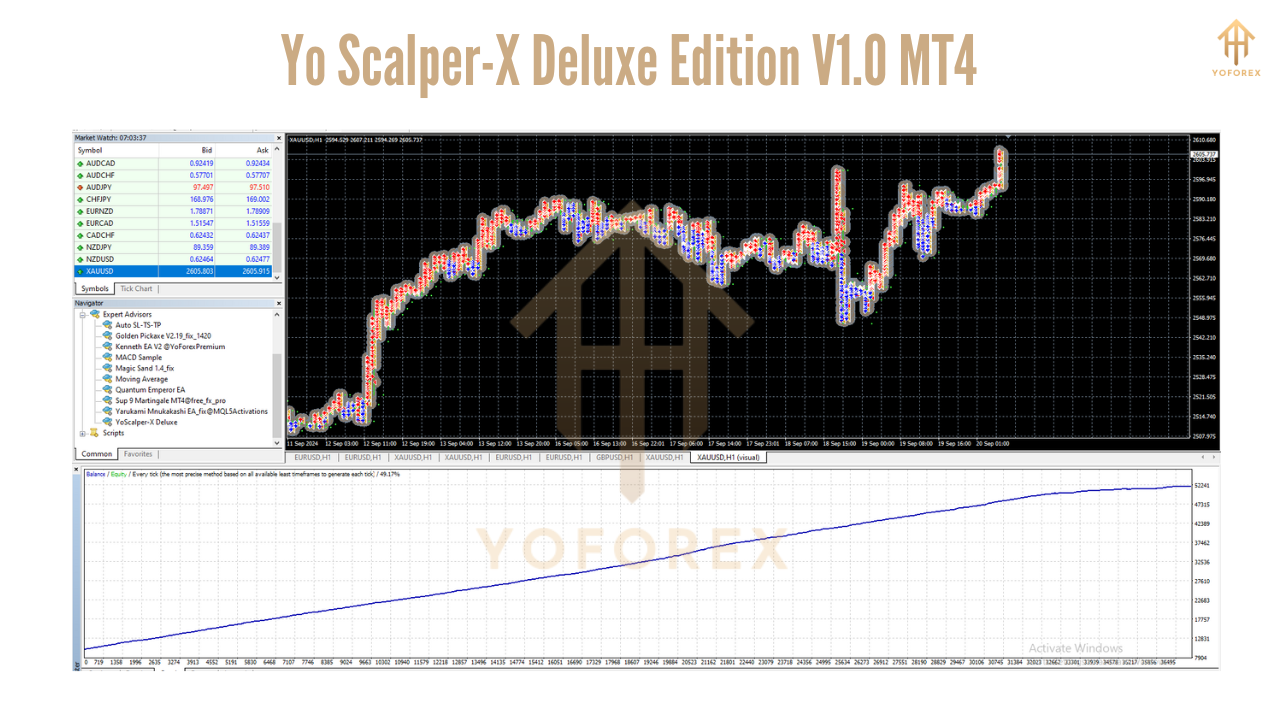

When choosing between the Yo Scalper-X Deluxe Edition and the Swing Trade Hedge for Prop Firms EA V1.0 MT4, aligning your selection with your trading objectives and risk tolerance is essential. Both tools cater to distinct trading styles and goals, offering unique features tailored to specific needs:

- Yo Scalper-X Deluxe Edition is ideal for high-frequency, short-term trades with scalping strategies designed to capture quick profits in volatile markets. It suits traders seeking dynamic, fast-paced trading with customizable risk modes.

- Swing Trade Hedge for Prop Firms EA V1.0 MT4, on the other hand, focuses on medium-term swing trading with robust hedging mechanisms. It is best for traders aiming for steady growth and compliance with stringent prop firm rules, such as drawdown and loss limits.

Understanding your risk appetite, preferred trading strategy, and long-term goals will guide you in selecting the EA that aligns with your trading journey.